pmx-berlin

New in Town

- Messages

- 49

- Location

- Berlin, Germany

Are there any experiences how the evil brother SB handles this matter?

+1Are there any experiences how the evil brother SB handles this matter?

2. The prices are for the UK market including VAT, but excluding VAT for the world market. Every company can handle this as it wants, because pricing is free. This means that the end customer in the UK pays 680 GBP including VAT and all others outside UK pay 680 GBP excluding VAT. Therefore, the invoice also says 680 GBP and 0% VAT.

I don't understand how you can justifie this to yourself...

It's either Aero scamming people outside of the UK by not telling them they are keeping the value of the UK VAT for themselves, or it's Aero telling customers outside of the UK that they deserve to pay a 21% foreigner tax for ordering from outside the UK.

Either way, it is a crap thing to do, it might not be illegal, but it is definitely immoral.

Customers outsid of the UK don't pay actual VAT twice, but they do pay VAT value twice, it's just that Aero is keeping one of the payments.

My invoice from early 2020 said 0 VAT. I'm surprised reading the law text that the IRS are so lenient in businesses abilities to zero tax export goods.Second try.

The way i understand it this is what is currently hapenning.

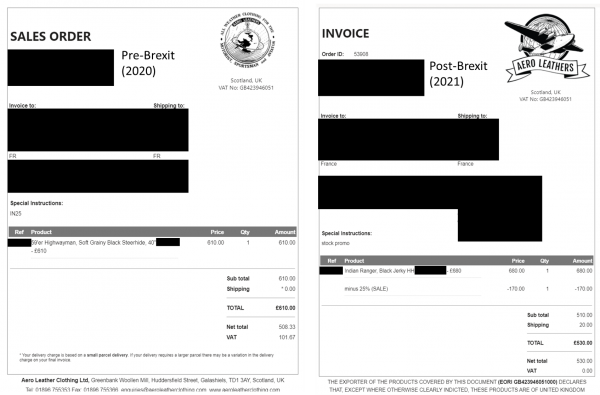

You buy from the UK, you get an invoice like this:

Clearly, Aero is charging you 662.50GBP, but they are paying 110.42GBP VAT, so they are making 552.08GBP on your sale.

If you buy from outside the UK, you will get an invoice like this:

Aero is charging you 662.50GBP, but they have no VAT to pay on that sale, so they are keeping 650GBP for themselves, and you get the privilege of paying an extra 20% VAT to your own country. You paid VAT value twice, only one was a legitimate VAT payment, the other one was just an Aero "foreigner tax".

If Aero showed VAT free prices on their website and only added VAT to the UK sales i could understand your point, but with the way they are doing it they have clearly just decided they where ok shafting non UK customers.

(full disclosure, i edited the second invoice as an example, if someone has pre and post Brexit invoices buying from outside the UK to show i would love to see them.)

Here's mine, pre-brexit sale shipped to the Netherlands.Second try.

The way i understand it this is what is currently hapenning.

You buy from the UK, you get an invoice like this:

Clearly, Aero is charging you 662.50GBP, but they are paying 110.42GBP VAT, so they are making 552.08GBP on your sale.

If you buy from outside the UK, you will get an invoice like this:

Aero is charging you 662.50GBP, but they have no VAT to pay on that sale, so they are keeping 650GBP for themselves, and you get the privilege of paying an extra 20% VAT to your own country. You paid VAT value twice, only one was a legitimate VAT payment, the other one was just an Aero "foreigner tax".

If Aero showed VAT free prices on their website and only added VAT to the UK sales i could understand your point, but with the way they are doing it they have clearly just decided they where ok shafting non UK customers.

(full disclosure, i edited the second invoice as an example, if someone has pre and post Brexit invoices buying from outside the UK to show i would love to see them.)

I doubt the UK authorities are gonna take action over this grey area. It is not like they are evading UK VAT so what if there are price discrimination as long as it is on the overseas buyer.Just to restate, « worldwide price » isn’t a thing. They’re either collecting VAT or not collecting VAT when you’re buying the item. If they’re collecting UK VAT, it should be deduced when they export it to another country for the applicable VAT to be applied by the customs upon entry. Customs duties and fees are a different story and is an up-charge to import goods. An item cannot be VAT inclusive and non VAT inclusive with no variation in price just based on the country of shipping otherwise you’re either over-collecting or sub-collecting tax for it. This wouldn’t sit well with your local Treasury Office unless you’re invoicing differently to the customer and in your books but that’s not legal and penalizes the customer so it’s a weird practice for a business. Worst case you’re pocketing the difference but that’s also illegal.

Well, it is arguable because price discrimination is like any other type of discrimination, so if it is aimed at race, gender or nationality, it may be illegal.I try again to explain my point of view. Unfortunately my English is really bad, but I hope that it will be reasonably understandable.

1. Do I like the way Aero handles VAT? No, definitely not.

2. Is it illegal? I do not think so.

I'm trying to explain that.

If a company in UK displays a price on an advertisement, website or similar, then this price for the end customer in UK must include VAT. For business customers, the price is usually shown without VAT, as VAT is not relevant in B2B.

So if an end customer from the UK orders a product from Aero, then it is clear that the price, e.g. 680 GBP, includes VAT and that the VAT is also shown on the invoice.

Exactly the same applied to EU customers before Brexit, as this was regulated accordingly.

I think we can certainly agree on that.

If a company in the UK exports goods to another country, the company is allowed to set the VAT to 0 because the VAT is only relevant if the goods are used within the UK.

Before Brexit, this already applied to all countries that were not in the EU and, since Brexit, also to exports to the EU.

I think there should be agreement here as well.

In the case of an export, the company in the UK now has two options:

1. The prices are for the UK market as well as worldwide including VAT. In this case, the company will deduct VAT from the price when exporting and show 0% on the invoice. When importing, e.g. into the EU, the VAT of the respective country is due and thus all end customers, regardless of whether they are in the UK or EU, pay more or less the same price.

2. The prices are for the UK market including VAT, but excluding VAT for the world market. Every company can handle this as it wants, because pricing is free. This means that the end customer in the UK pays 680 GBP including VAT and all others outside UK pay 680 GBP excluding VAT. Therefore, the invoice also says 680 GBP and 0% VAT.

As long as there is no agreement that prices must also be displayed transparently for customers outside of the UK, there is nothing illegal about point two.

Assuming that the company in the UK makes the majority of its sales with exports and only a little within the UK, then the procedure in point 2 makes perfect sense from a business perspective.

Does this have to please an end customer outside the UK? No of course not. Can he do something about it? Also not as long as this is not regulated in trade agreements.

On Aeros website you can find the following:

"PLEASE NOTE: Your postage charge covers the carriage of the goods from here to your door and does not include any calculation of the duty/sales tax which may or may not be applied in any country which we export to.

Each countries' government have their own laws, regulations and tariffs etc. which they levy on such imports of foreign goods.

This is beyond our control regardless of which country goods are shipped to and is down to each governments' policy concerning the importation of goods."

That could certainly be presented in a more customer-friendly way and it could statet clear that prices are exclusive VAT outside UK.

In summary: No, we customers outside the UK do not pay VAT twice, but a different, higher price applies to us than to customers within the UK. Not pretty, but that's how it is.

Here's mine, pre-brexit sale shipped to the Netherlands.

View attachment 329537

I'm pretty confident that if I bought today, total amount would be equal to net total. I'm not ordering anything from Aero right now, because I do feel like they're pocketing 20% extra on my sale (and I'm effectively paying 21% more for the same jacket)

John Lofgren Monkey Boots Shinki Horsebuttt - $1,136 The classic monkey boot silhouette in an incredibly rich Shinki russet horse leather.

John Lofgren Monkey Boots Shinki Horsebuttt - $1,136 The classic monkey boot silhouette in an incredibly rich Shinki russet horse leather.  Grant Stone Diesel Boot Dark Olive Chromexcel - $395 Goodyear welted, Horween Chromexcel, classic good looks.

Grant Stone Diesel Boot Dark Olive Chromexcel - $395 Goodyear welted, Horween Chromexcel, classic good looks.  Schott 568 Vandals Jacket - $1,250 The classic Perfecto motorcycle jacket, in a very special limited-edition Schott double rider style.

Schott 568 Vandals Jacket - $1,250 The classic Perfecto motorcycle jacket, in a very special limited-edition Schott double rider style. The issue is two-folded as illustrated in the link I posted.The likely solution will be for Aero to raise their price ex-VAT so everybody including UK customers will pay a little bit more but foreign customers would not be charged this shady hidden VAT (on which they also pay local taxes). This is how it normally works. Not sure what it has to do with any new website.

The likely solution will be for Aero to raise their price ex-VAT so everybody including UK customers will pay a little bit more but foreign customers would not be charged this shady hidden VAT (on which they also pay local taxes). This is how it normally works. Not sure what it has to do with any new website.

... maybe it is a form of patriotism?